Reconciliation Tool in Odoo 14

There are multiple obligations that companies must go through every month. Most of them are indispensable for the good flow of the business. To match those needs and help companies save time while meeting these obligations, Odoo innovated its Reconciliation Tool alongside many other features. Thanks to all these features like the reconciliation tool open source software is changing - improving - how you can do business.

Here we’ll focus on the Odoo reconciliation model tool. If you want to learn more about other features, make sure you

browse our articles.

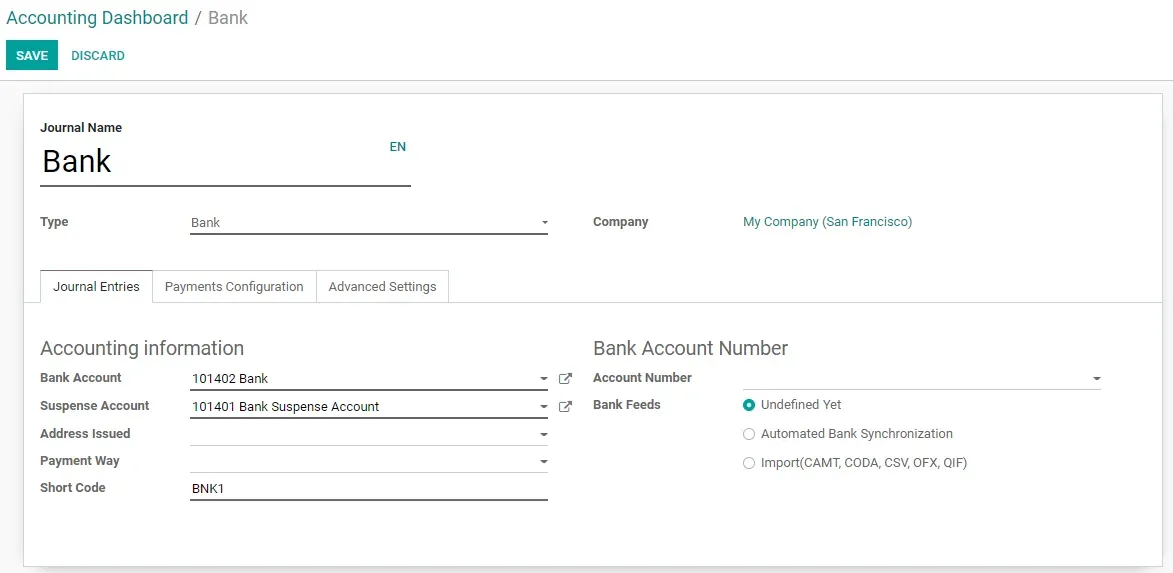

Journals

Let’s start by talking about the new fields you have available in Journals, since this is where the magic happens. As I mentioned above, the main goal of Odoo is to help you with your day-to-day work and save you time on indispensable tasks. To make this happen Odoo 14 now has a Bank Suspense Account field and Outstanding Payments Accounts. Since the reconciliation process starts with the Journal, let’s understand what these new fields are for.

On previous Odoo versions, when you create a Bank Statement no Journal Entries are generated. This will only happen during a bank reconciliation process with an invoice/bill, or if you manually write off a transaction into an income or expense account. Not on Odoo 14!!

In Odoo 14, as soon as you generate a Bank statement and Post it Odoo will generate an Accounting Entry or Entries

depending on the number of statement lines in your bank statement. Well, to make sure we keep track of each statement

and that we have an up-to-date balance sheet and dashboard, these values will not only hit the Bank Account but also

the new Suspense Account.

To balance this, whenever you reconcile a Payment/Receipt with an Invoice/bill the value added on the Suspense account

will be moved into the new Outstanding Payments/Receipts. The big change here is that when you register a Payment or

Receipt it won’t directly hit your Bank account but these new fields for Outstanding Payment/Receipts.

To sum up, when you register a payment/receipt it will hit one of these accounts and when you do a bank reconciliation

bank journal entries will hit the bank account there.

You can see that with Odoo accounting software bank reconciliation is now easier than ever before.

Discover More Odoo 14 Accounting Tips

Payment Status

Previously in Odoo 13 you had the choice to see the Payment Status on a list view of your Invoices. Now, in the new Odoo reconciliation model, this filter is built by default in your pipeline and has a new stage called “In Payment” for when you register the Payment. This new Status is a middle stage for Not paid to Paid. Payment status will only move forward to Paid when you reconcile this Bank/Cash Statement. As mentioned, Odoo 14 has improved the list view with more colors and better organized information.

Odoo for eCommerce - Learn how it can benefit you

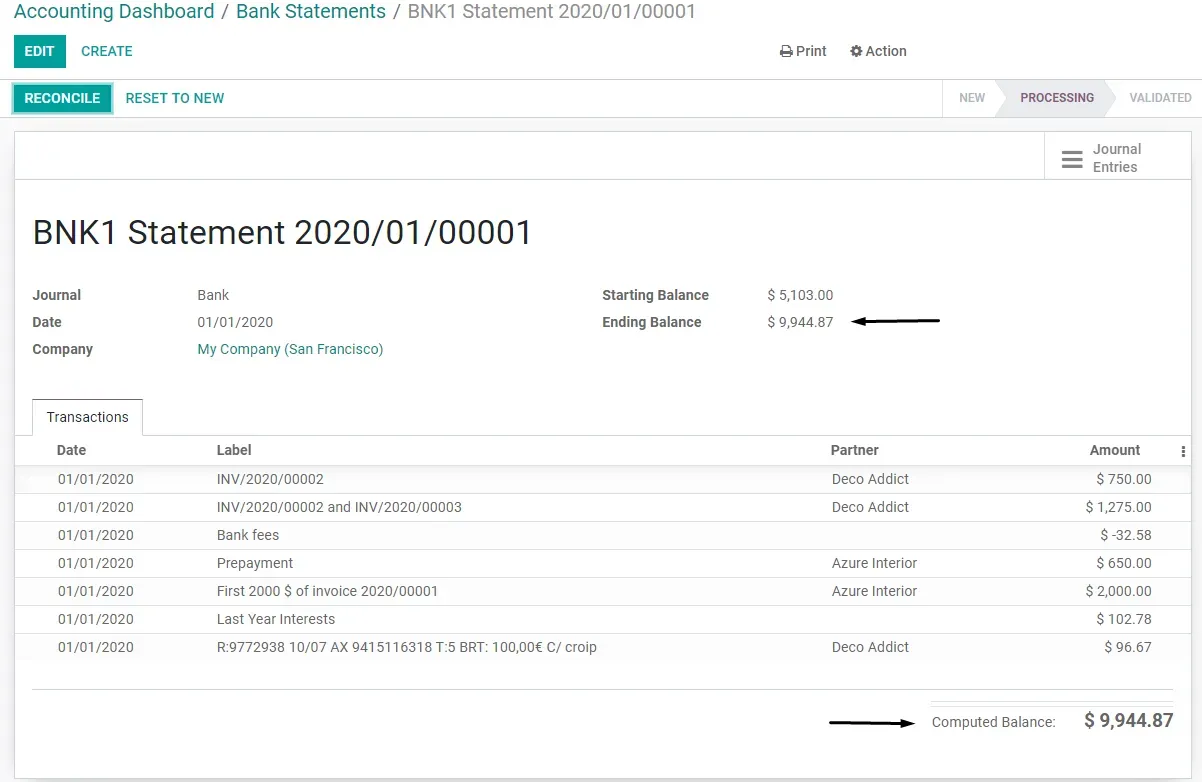

Bank Statement Posting & Resetting

As you probably already know, you can import your Bank Statements directly into Odoo, synchronize with your Bank or even

do everything manually. The main changes regarding this are related to the posting of these Bank Statements. The first

major change we notice when we take a look at our Bank Statements is the two new buttons to either Reconcile or Reset

your Bank Statement to New.

To sum up the process, when you create a Bank Statement Odoo will Post the Journal entries accordingly to the accounts

you previously chose as well as the new Suspense Bank Account. Having this workflow will give you an up-to-date balance

sheet and Dashboard report. Resetting the Bank Statement to ‘New’ will of course unpost all entries so you can make all

changes required and then Odoo will post them again following the same logic.

Even before all this, Odoo has a new amazing rule that when your Ending Balance doesn’t have the same value as your

Computed Balance Odoo won’t let you move forward. This rule will help ensure there’s no mismatching or any other error

whilst doing this Bank Statement.

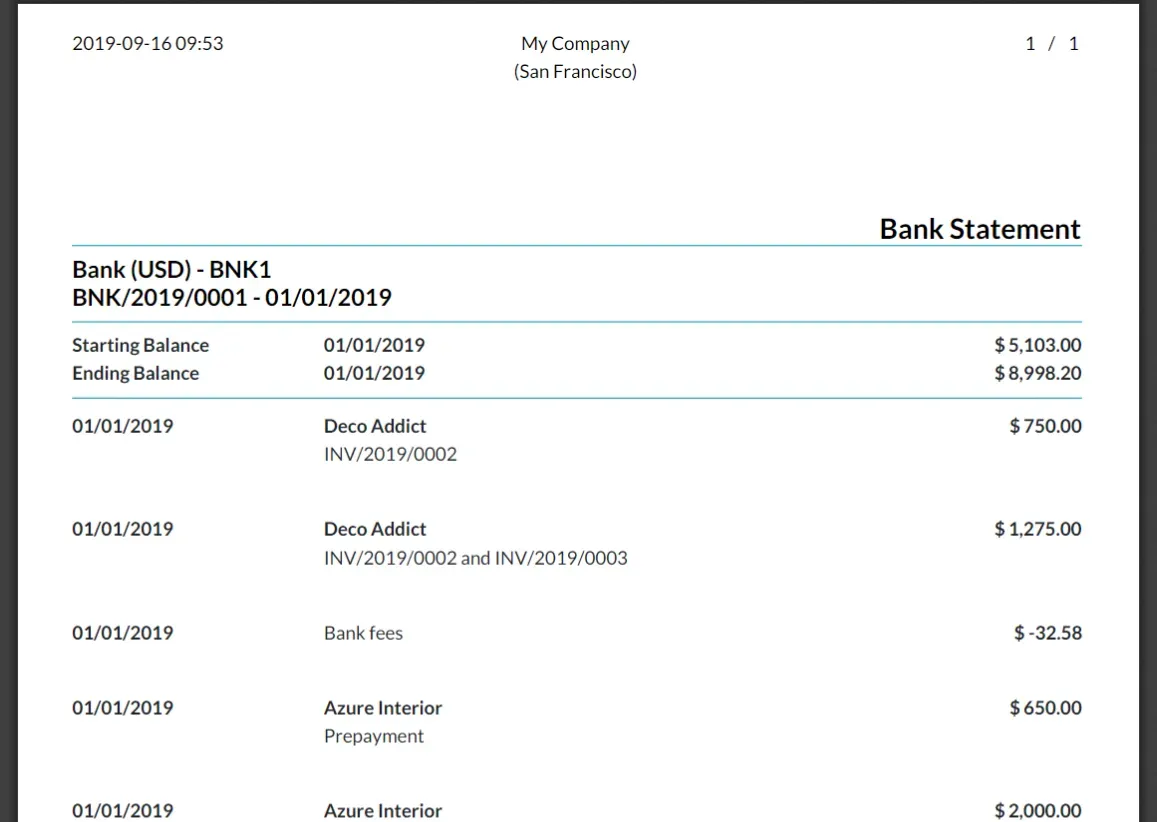

We know you appreciate having detailed, useful reports on hand when you need them. To make this happen Odoo 14 now has a new PDF Report that will mimic what you did in the Bank Statement. This Report is automatically generated and attached to the Bank Statement Operation.

Need Help Customizing Odoo to Your Needs?

Reconciliation Models

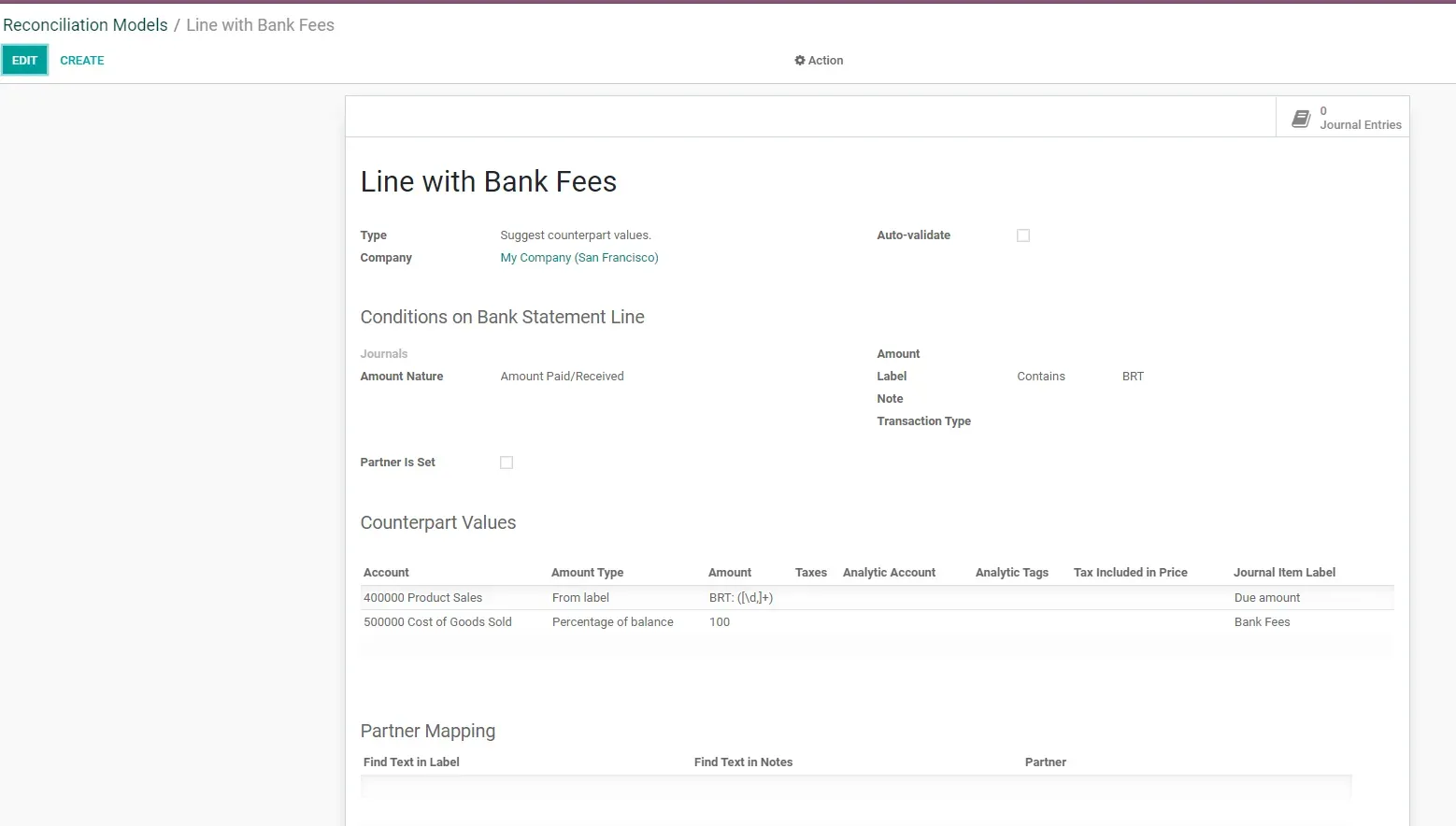

The Odoo Reconciliation Model is great for automating and expediting the process of your reconciliation by telling Odoo

what information to look for and recommending what you might need to reconcile. To improve the Reconciliation Models,

Odoo has expanded on the use of Regex, Improved Invoice and Partner Matching.

Taking a look into a Bank Statement Reconciliation, you’ll notice some Counterpart Values, where you’re allowed to split

a single bank statement line into different buckets. During a bank reconciliation process, Odoo will find it based on

the Regex and you simply need to validate it and post it.

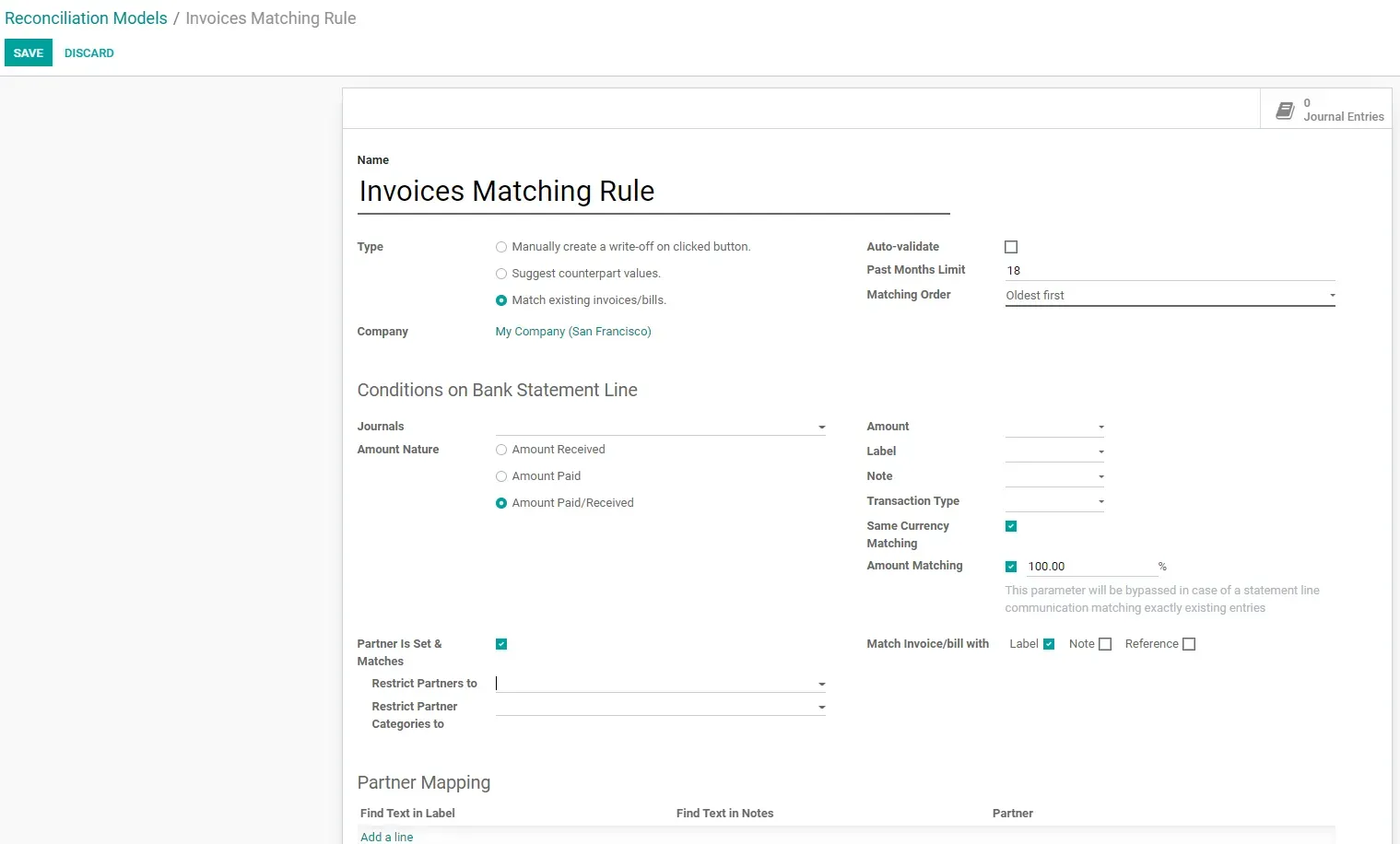

Regarding the Invoice/Partner Matching, while in your Reconciliation Models you have the type Match Existing

Invoices/Bills where you can either set a time limit or stipulate how far back in time you allow your reconciliation.

This way you can filter out transactions that you no longer need to see. Underneath it you’ll have the option to order

the information that is displayed, Oldest First or Newest First.

One other great feature is the Match Invoices/Bills with where you choose other information (such as, Label, Note and

Reference) that will be used to help the bank create the perfect matching. This new feature is a great achievement

because not all Banks display the same information, therefore choosing which information to look for will definitely be

helpful. Last but not least, there’s a field for Partner Mapping, where you can teach Odoo where to look and what to

look for when it comes to your business and day-to-day work.

With this reconciliation tool open source resources make it easy to customize features to your needs. The ERPGAP team are experts at helping clients. So, how can we help you?

Reconciling Partial Payments

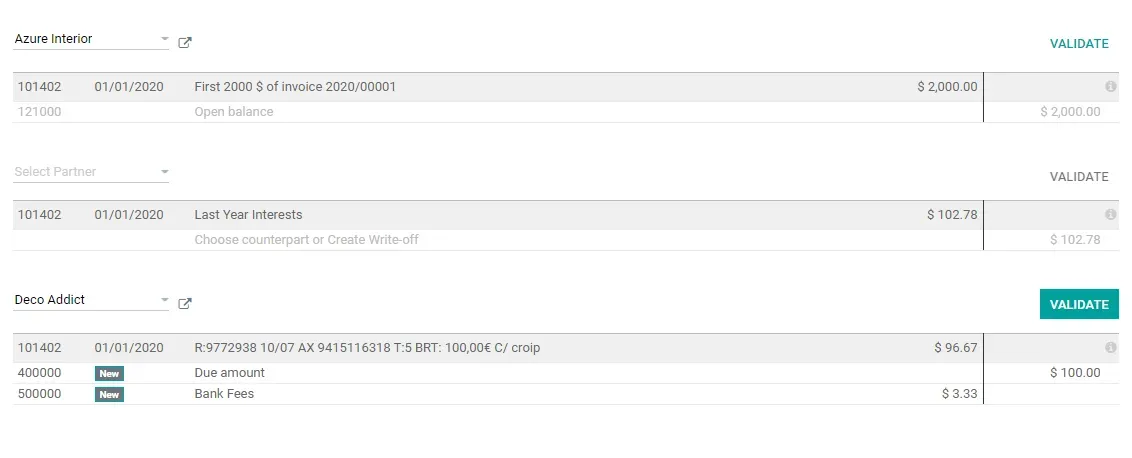

Now let’s take a look at the bank statement reconciliation process itself.

Until now we’ve set up our Journals and rules that will simplify our job from this point forward. The reconciliation

process makes it easy and fast to record partial payments, which is used in companies that do same-day transactions.

There aren’t as many changes in terms of UI when you go to your bank reconciliation, however you’ll notice that you’re

now able to reconcile partial payments with one click only. The smart Odoo reconciliation model tool indicates and

matches each payment to its corresponding tab and if you have a payment value that should hit different accounts, Odoo

will take care of it for you.

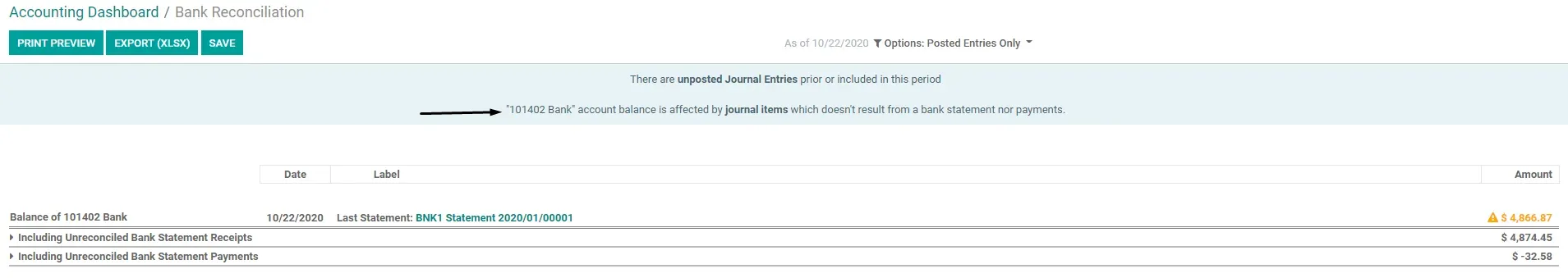

Manual Journal Entries

Here is where Odoo has made big changes and really focused on improving the Odoo reconciliation model feature. Previously you couldn’t reconcile your bank statements with a manual journal entry. You could only do it with an open invoice/bill or maybe by manually writing off the transaction. Now during bank reconciliation, bank journal entries are handled effortlessly. Odoo allows you to hit a Bank Account with a Manual Journal Entry and then Odoo will display all these bank transactions on top of your Bank Reconciliation Report. Here (on the bank reconciliation report) you can see all the differences that were manually generated whilst going on in your transactions. You can directly reconcile them, which is a dynamic and much requested feature.

Still have questions regarding the Reconciliation Model on Odoo 14? Don’t hesitate to Contact Us or go ahead and Book a Consultation with us.