As you might have heard, Odoo has released a new version (14) on the 1st of October and we were on top of this new Odoo Experience. If you’re wondering what’s new on Odoo 14 you’ve come to the right place. Our team has decided to write this fresh new article to help you understand what the new features are you can encounter inside Odoo 14. If you want to learn more about Version 14, make sure you check out our other articles.

Introduction

This past year Odoo has been working with accounting specialists in order to provide the best accounting module possible for its users. As a result of this “partnership” we previously announced more than 100 new features in Odoo 13. Check this article if you missed it. Now Odoo listened to your requests and improved the accounting module even more in Odoo 14.

Accounting Module in Odoo Version 14

So What’s New in Accounting Odoo14 ?

There are a lot of new features and details in the accounting module for Odoo 14. I’m going to list all the major improvements, but there are many more features that can be useful. Make sure that by the end of this article you contact us so we can show you how we can adapt the modules to suit your company’s unique needs.

Odoo and Accounting: Find Out More

Widgets

Let’s start from the basic view of accounting, our List View. Odoo 14 has an amazing improvement in terms of displaying and interacting with useful information displayed in the List View. These new widgets have the purpose of keeping you informed about important dates, tasks or even status of the operations. To keep this information well displayed Odoo uses different colors to represent each situation. Furthermore, with this new List View you’re able to plan activities, follow up with existing ones, set them as done and so much more without switching to a different view.

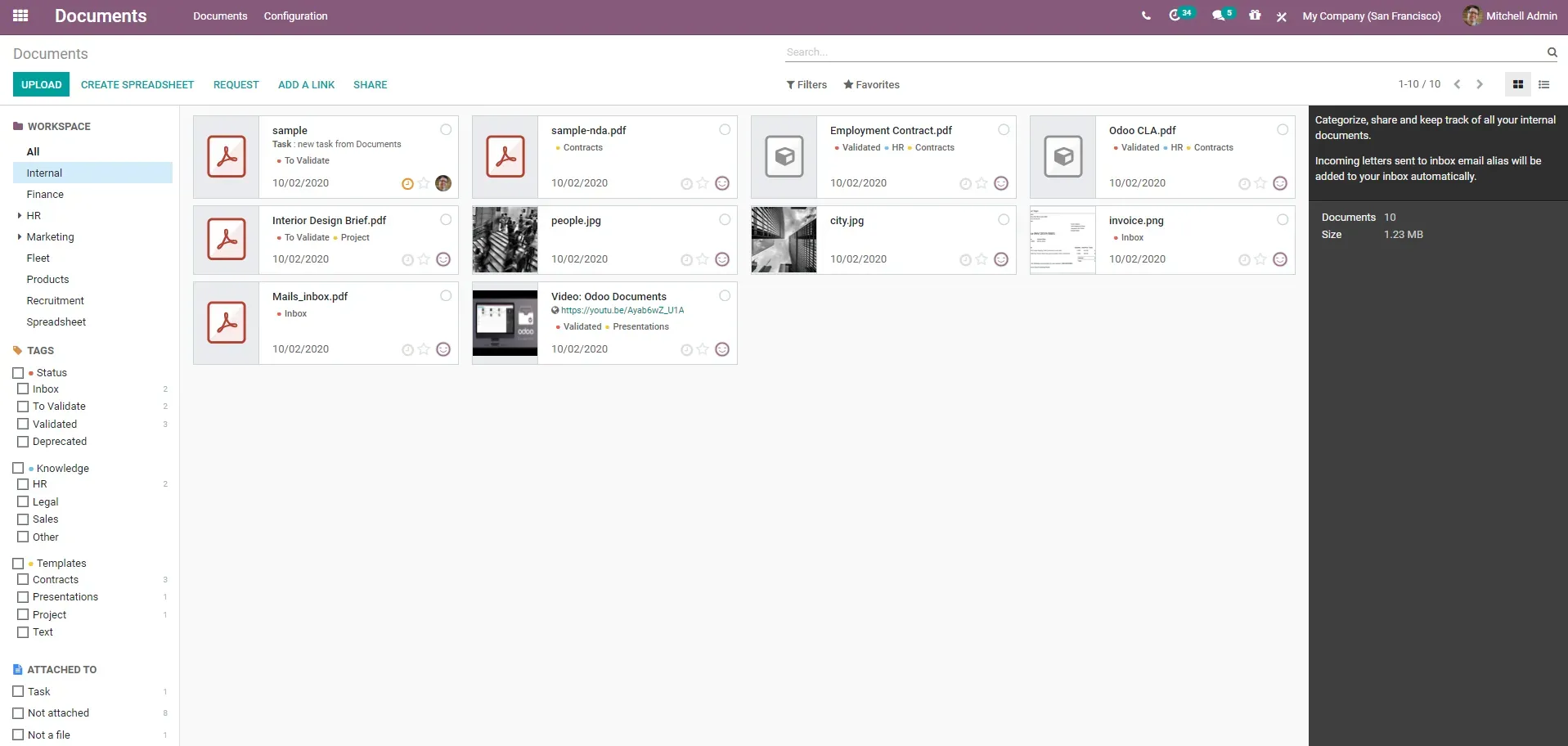

Manage Documents (Artificial Intelligence)

One great accomplishment with the AI used to read imported documents is that it now has a success rate of 96%, which is a big accomplishment since it allows you to save time and automate previously manual processes. This new AI will take a look into all the fields that need to be filled in order for your document to be completed, such as:

- Total amount

- Subtotal

- Currency

- Dates

- Supplier

- Bank Account

- Reference

- Tax amount

An additional recognition is that Odoo will try to categorize what kind of expense it’s digitizing. Odoo’s main goal is to transform your company into a paperless business. To do it there’s now a feature that allows you to split and merge different documents in Odoo. As you know, by setting an email alias you can get all bills that are sent to you into the Documents application, not only Vendor bills but also other types of expenses. With this app you can assign each document to its representative team (and only they can see it) and organize each document without leaving the Documents app (set the status, set tags, attach it, set the fiscal year, etc). After this you’re ready to Create a Bill in Accounting.

One great feature that we mentioned above is that Odoo AI will recognize what type of expense it’s digitizing (if it doesn’t recognize the first time, don’t worry, you set it up manually once and Odoo AI will learn from it). Therefore, you don’t have to manually change your Expense Account. Thanks to this, you’ll have your Journal Items properly entered.

There are many other ways Odoo can benefit your company, even for eCommerce.

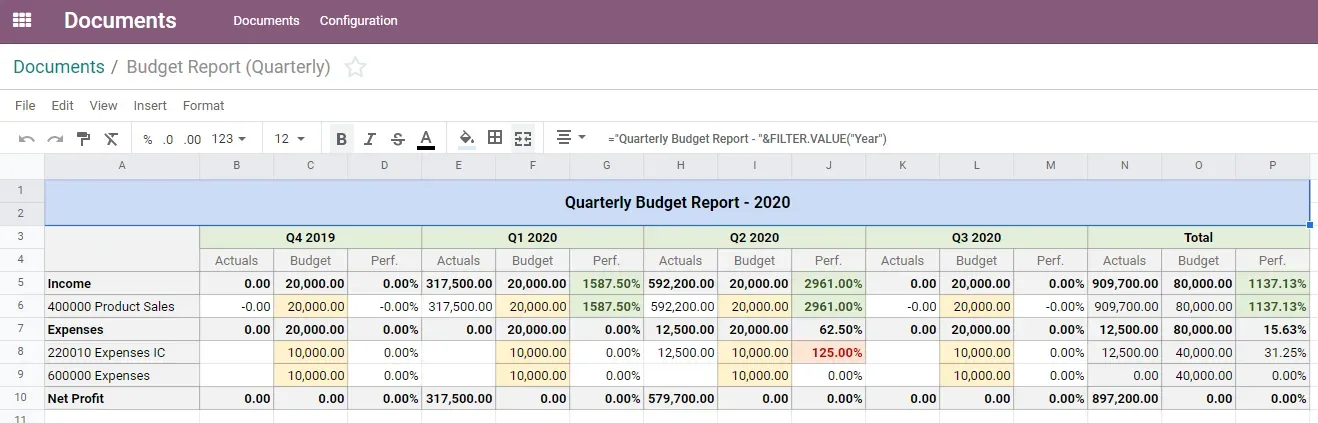

Reporting

Taking in consideration our business experience and expertise, we’re very excited with the new feature for reporting Spreadsheets. With this new Spreadsheet report you’re able to create the most complex reports and above all with up-to-date data.

But how does it work ?

Instead of working only with your own customized spreadsheets (which obviously you can), Odoo actually prepared some report Templates that are usually useful for every business. Let’s say you want to take a look into your Journal Items and require an informative report about the past 6 months. Simply choose the Pivot View

and you’re now ready to build/adapt your report by using all the available filters.

Handy tip: don’t forget you can also save your settings as a favorite view so that it’s there as default and you don’t

need to redo it in future.

After this you’re ready to create your first Spreadsheet in Odoo. This action will take you to an inside view of Odoo in which you can actually improve and set formulas similar to traditional spreadsheets you’re accustomed to. To ensure accuracy, any data changed after you generated the report will be updated so you have real time representation of your books.

Why Invest in Odoo Accounting?

Currency Report

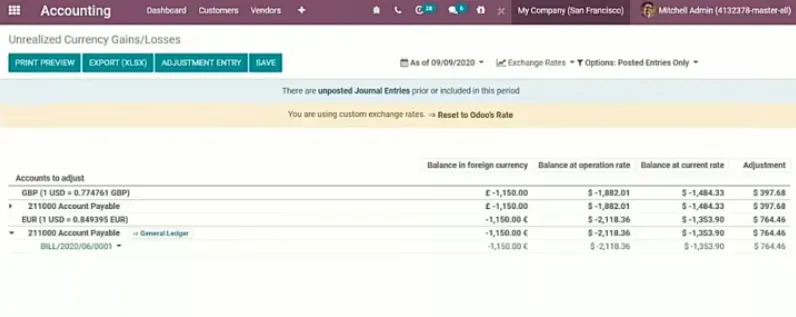

Until now you had various ways of dealing with different Currencies in Odoo, such as, view or edit the currencies rate, automate the calculation of the current currency by synchronizing it with European Central Bank or set up a specific currency for an account in the Chart of Accounts. Also, inside each Journal you can select the corresponding currency as well as in each bill/invoice you generate. All of these features are available in Odoo 14, however some companies need even more information about the Currency. Therefore, one helpful update related to the Currencies is a new Report of Unrealized gains/losses and the power of real-life-time balance sheets.

But how does this work? You now have access to a new report: Unrealized Currency Gains/Losses. This will display all open amounts on your balance sheet that need/could be reevaluated. This information is grouped by the Currency and their respective accounts. Taking a closer look at the columns and the way to interpret this information, you have 4 different columns:

- Balance in a foreign currency: This is the value that came within the Bill

- Balance at operation rate: This is the balance calculated in your currency at the time you received the bill (at the operation date).

- Balance at the current rate: This value informs us of the amount we would get if we got paid right now. It’s the current value at the time of the report

- Adjustment: This value should be added into the accounting in order to update your accounting reports with this new information.

As stated before, you can set your own currency rates or have Odoo calculate them based on a synchronization with the

European Central Bank.

The great advantage of this new feature is that if your company works with a lot of different currencies, now you have

an easy reporting system, with up to date, real-time data, that informs you of all the Gains/Losses and the respective

adjustment you should make.

To do this adjustment (update your balance sheet), you have a button at the top of the report called “Adjustment Entry”. By clicking on it you’re now ready to select in which Journal you're going to process this account entry:

- Select your Expense/Income Account

- Choose the date you want this to be reported

- You will also confirm what entries will be done

Once you confirm all these steps, your adjustment is basically done (Yes, it’s that easy). You can even double check by returning to your Unrealized Currency Report and confirming that your Adjustment is now 0 (zero).

Taxes

Odoo already has many reports that are useful for accounting. However there was no solution (at least internal) that would track your Fiscal Result. Odoo 14 comes in handy when you want to improve the way you deal with your Taxes. To do this, Odoo has created a new Report regarding disallowed expenses (expenses that aren’t deductible in the Fiscal result but are deductible in the booking result):

- Create Disallowed Categories with the relevant legal percentages

- Go to your Chart of Accounts

- Link your expense account to each Disallowed Category

That’s how simple it is!

Another great Odoo 14 feature is the wider range of dates you can now choose to check your Tax Return. The main goal and benefit here is that you can adapt Odoo to your country-specific Tax Return Period and even get notifications/warnings on when the due date approaches. To finalize Taxes, Odoo has made it possible to remove P/L accounts directly from VAT reconciliation Journal entries. So by the end of your Tax Period, you can just create a Journal Entry in order to reconcile all the amounts of the VAT and what you’ll have to pay or receive. That’s why removing P/L accounts is a great feature!

Learn About Odoo for Manufacturing Industry

Payment Refactoring

The main reason why Odoo 14 improved its Payment Refactoring is so you can now have the balance sheet updated in real time and synchronized with your bank statements. The first step Odoo took to improve this was by adding a Suspense Account in each Bank Journal you might have. This suspense account will help you keep track of real-time bank transactions. What was, and still is, great with this Bank account, is that you keep a direct relation between the Balance Sheet and your Bank Account. However, the suspense accounts come in handy because this account will be automatically updated as soon as you start to reconcile your bank entries. Some other news on Odoo 14 is that it now has some transfer accounts and a different way of tracking payments. These two new Transfer Accounts are:

- Incoming Payments

- Outgoing Payments

For each of these, all your bank payments will be tracked in these accounts until you reconcile them. Now you have an

easier way to keep track of the statements that are yet to be reconciled. No more wondering where all your Outstanding

amounts are! :D

Finally, Odoo 14 also made some changes on the reconciliation overview. Because of manually inserting Journal Entries,

it could be tricky to find the differences between your General Ledger and your Bank Statements. However, Odoo will now

notify you about accounting entries that were not reconciled by Bank Statements or Payments.

Implementing Accounting (from Other Software to Odoo 14)

Many clients use different accounting software instead of using Odoo’s dynamic accounting module. This happens because

users don’t want to lose track of all previous information when updating their accounting. To solve this, Odoo 14 now

has an effective way for you to import your Opening Balance and still keep track of previous entries. All you have to

do is set up the date on which you would like to start over with Odoo 14 accounting and we’ll make sure we archive all

necessary entries. All previous invoices/bills will now have a new status “Invoicing App Legacy”, which means that

everything remains in the system but the account entries have been archived.

Not only is this a helpful feature, but you’re now also able to update sequences in a batch mode. For example, let’s

say you have some references that you import from an older system. You can now resequence those references as you wish.

You can see how flexible and dynamic Odoo is. Did you know you can even use it as your CRM?

New Localizations

Odoo 14 is now ready to work on these 3 new Countries:

- Algeria: Odoo added their Chart of Account

- Finland: There is a Chart of Accounts but also Accounting Reports

- Sweden: Odoo added the Tax Report and the XML export to directly update it in the government website.

Other than these new localizations, Odoo14 has also improved its features in various countries such as, Luxembourg (COA & Electronic Reports), Switzerland (Swiss QR code), Denmark (COA & Tax Report RF0002), Argentina, Chile and Peru (Electronic Invoicing), Australia (TPAR report), France (COA, Tax Reports & Accounting Reports) and for Romenia (COA & Tax Reports)

Miscellaneous: Preview of Accounting Entries

To conclude this article with the new features of Odoo 14, I would like to talk about two miscellaneous features that you’re sure to find helpful.

Firstly, there’s the new role you can assign to your Auditor, where you control their access-rights into read-only. This way you avoid the audit changing any of your current values.

The second item is that you can now preview accounting entries before you validate them. Therefore, you won’t have unexpected surprises.

In conclusion, Odoo 14 brings you more confidence and power. We can guarantee our clients that we’re able to turn their accounting into an easy and automated process. We offer custom options and we’re here to support, according to the service package that suits you.

Considering all the improvements that were made, not only on Odoo 14 but also with the previous ones from Odoo 13, you

now have a dynamic accounting module capable of dealing with diverse accounting systems of different companies.

Remember, despite all these new features I listed there’s still a lot to be shown. Make sure you contact us

or simply Book a Consultation so you can discover what Odoo 14 can do for you.

Implement your accounting in Odoo 14. We are here to help you streamline the process so you can experience more success and better workflows than ever before!