In every taxation system, businesses are obligated to pay taxes determined by their earnings, expenditures, and assets. In the United States, this tax burden is distributed across both federal and state levels, with distinct authorities responsible for imposing and collecting these taxes. This demarcation ensures that the federal government does not have the authority to intervene in the way a specific state administers its tax framework.

How Taxes Work in America

Taxes in the United States are levied by various government entities, including federal, state, and local governments. Here's a brief overview of the key tax categories:

- Federal Income Tax: This is one of the primary sources of revenue for the U.S. government. American businesses are required to pay federal income tax on their profits. These are progressive taxes, meaning higher-income individuals pay a higher percentage.

- State Income Tax: Most states have their own income tax systems, which vary in terms of rates and rules. States like Florida and Texas have no state income tax.

- Sales Tax: State and local governments impose sales tax on the purchase of most goods and some services. Rates vary by location and type of product or service.

- Property Tax: Local governments levy property taxes based on the assessed value of real estate. These funds support local services like schools and infrastructure.

- Business Taxes: Businesses may be subject to federal and state corporate income taxes, payroll taxes, and various other taxes depending on their structure and location.

How Odoo Software Handles Taxes

In today's fast-paced business environment, American companies face a multitude of tax regulations and compliance requirements. Keeping up with these obligations can prove challenging.

Luckily, Odoo offers innovative solutions that streamline the entire process, eliminating the need for manual intervention. As a result, companies can make notable savings in time and cost, which they can allocate to more critical operations.

With Odoo's software for business management, companies can leverage robust tools to manage their accounting and tax needs. Users have the option to customize tax rules to meet their specific requirements. These rules can apply to sales tax, Value-Added Tax (VAT), and other custom taxes that are automatically calculated for invoicing, purchasing, and other financial transactions.

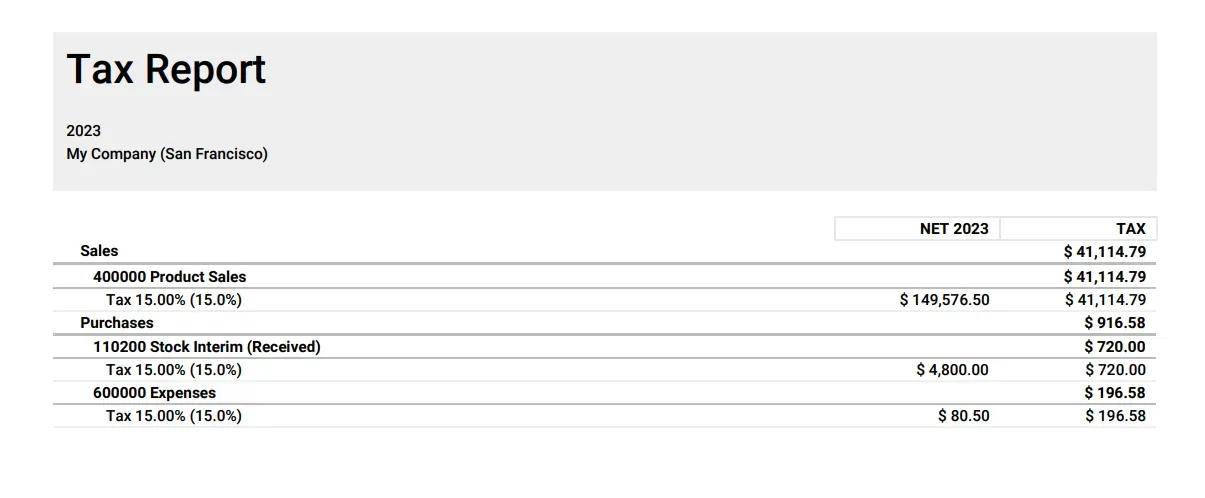

Odoo also enables companies to ensure compliance and make informed financial decisions by generating VAT and tax summary reports.

In addition to proposing manual tax rules, Odoo offers integrations with tax automation services to simplify tax compliance. Available options are:

TaxCloud: A cloud-based service that facilitates sales tax compliance. The Odoo-TaxCloud integration enables businesses to accurately compute and collect sales tax according to the customer's location. Furthermore, TaxCloud handles tax filing and reporting, alleviating administrative duties.

Avalara: It’s similar to TaxCloud and is another tax automation solution integrated with Odoo. It provides compliance services such as real-time tax calculations and automated returns. By integrating with Avalara, businesses can stay updated with complex tax regulations.

Easy Odoo Setup

Linking AvaTax or Taxcloud to Odoo's ERP system is a straightforward process that only requires a few steps to automate tax calculations for your company's daily operations.

However, it's crucial to establish this connection correctly to ensure that every detail conforms to the relevant tax rules of a state or even another country.

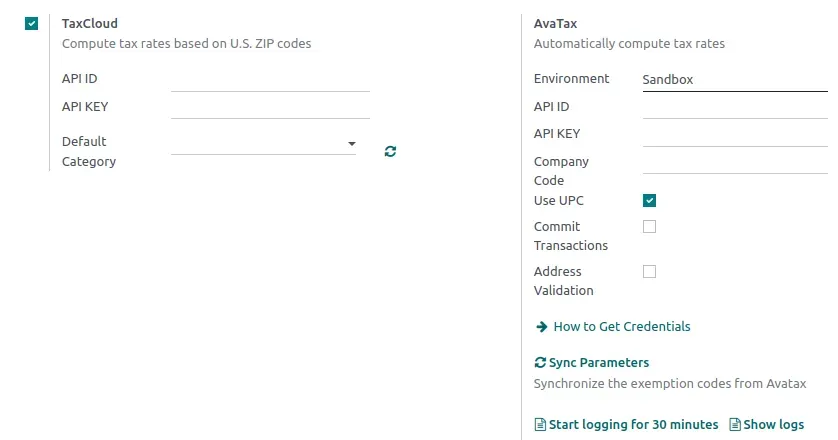

Step 1: Accounting Settings

The initial task is to access Odoo Accounting Settings and search for TaxCloud and AvaTax, as depicted in the image below. In this section, you will enter the AvaTax and TaxCloud credentials, integrating their functions with the Odoo ERP system. Be sure that your credentials align with those in your tax provider dashboard.

Step 2: Confirm Contact Details

Confirm that both your company and customer addresses are accurate, including state and zip code, to ensure proper transaction management. This is crucial since the state in which you sell from and to determines taxed items and tax rates.

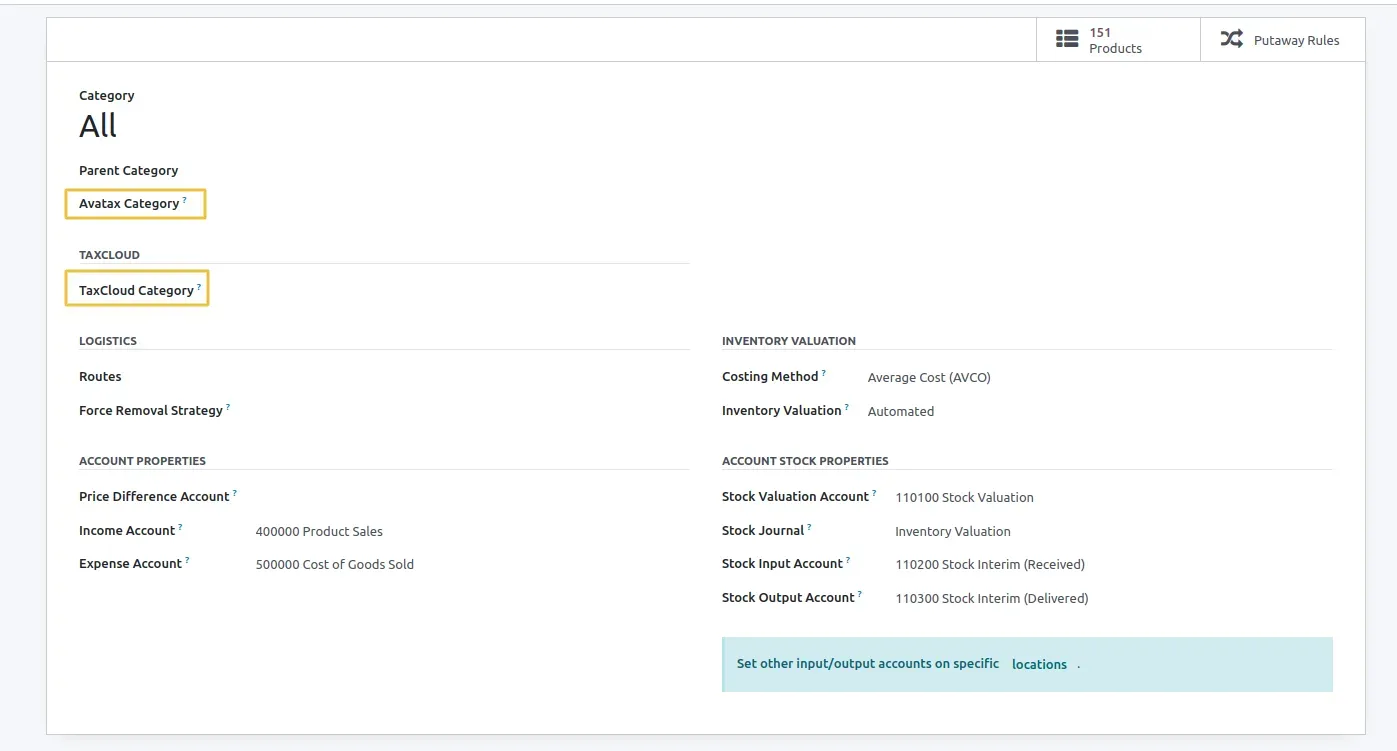

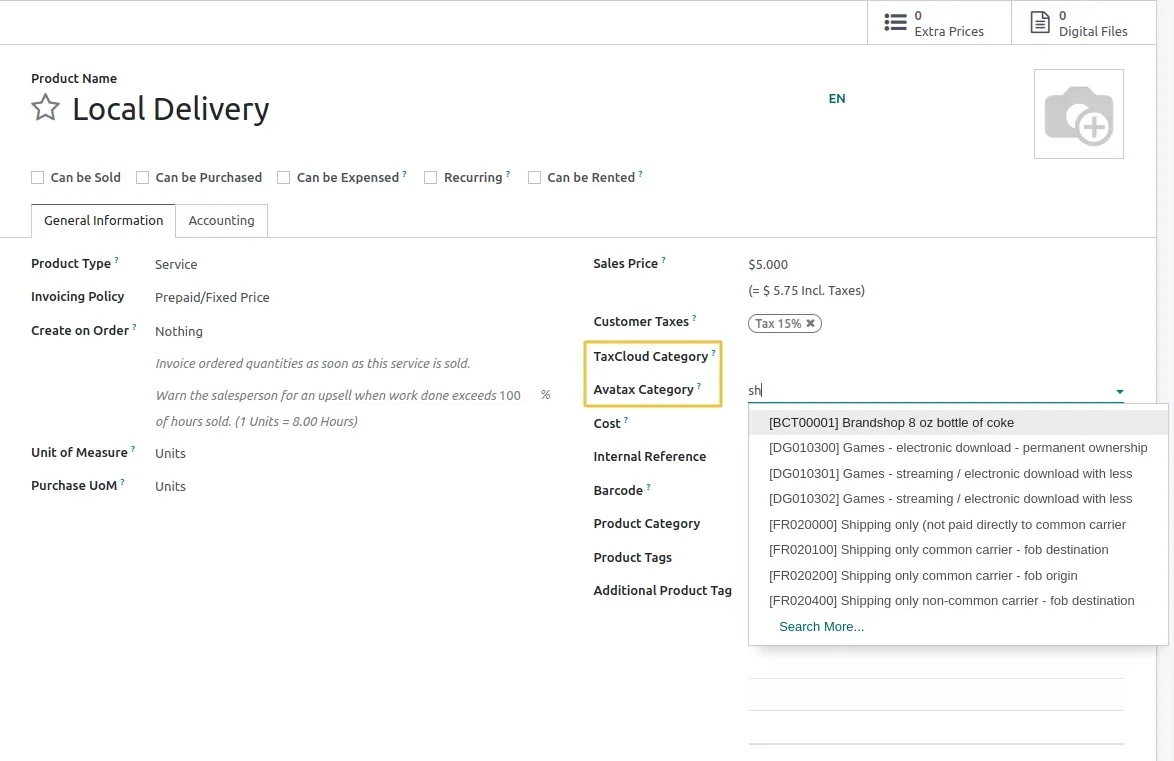

Step 3: Set Categories

A useful aspect to consider is the taxation of products based on their category in Odoo's Accounting Configuration.

Each category has varying tax rates, and some may even be exempt from sales tax. Correctly configuring this feature can save valuable time when calculating taxes for all your company's sales.

Important tip: Even though all the products your company sells may belong to the same category, shipping falls into a distinct category.

You have the option to choose the tax category for the product, which overrides the category selected for the product's category.

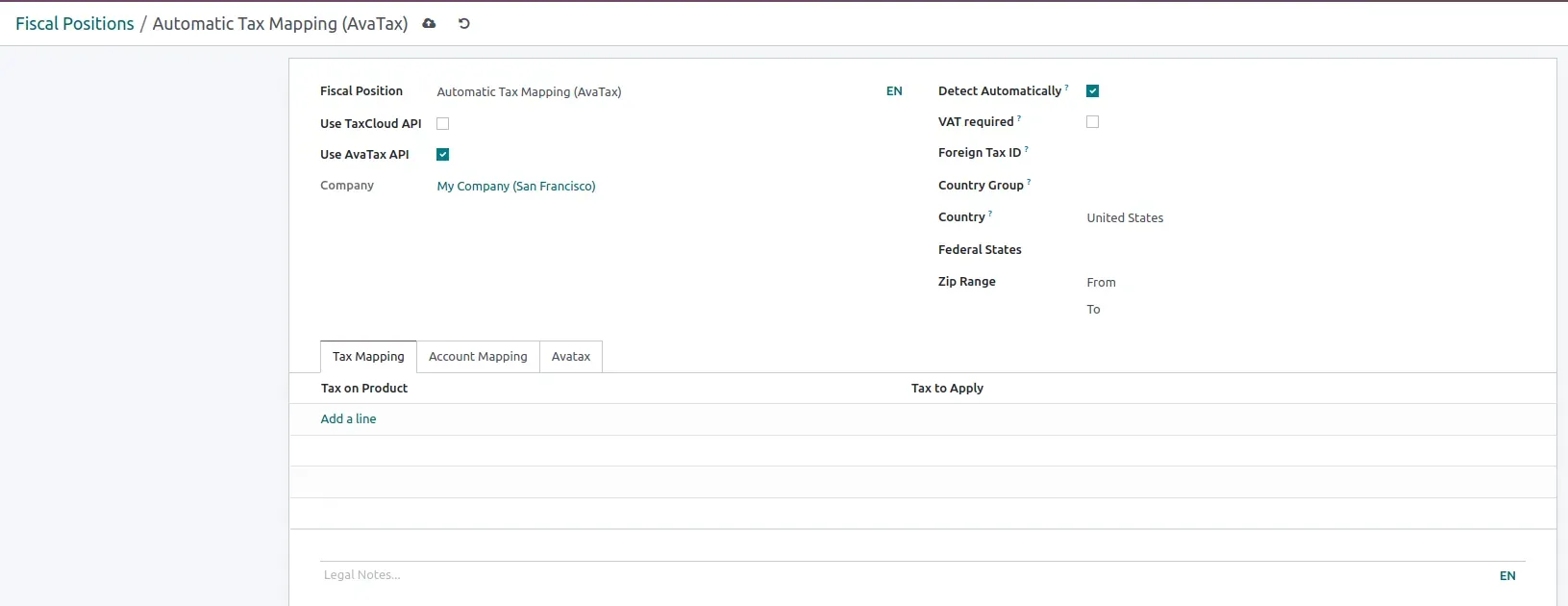

Step 4: Fiscal Positions

When working with either AvaTax or TaxCloud on Odoo, the system will automatically generate a fiscal position. This position gives the user the ability to establish rules that automatically adjust taxes and accounts used for a transaction, based on the customer or provider's location and business type.

TaxCloud and Avalara will automatically calculate taxes and determine the correct tax rate for your configuration.

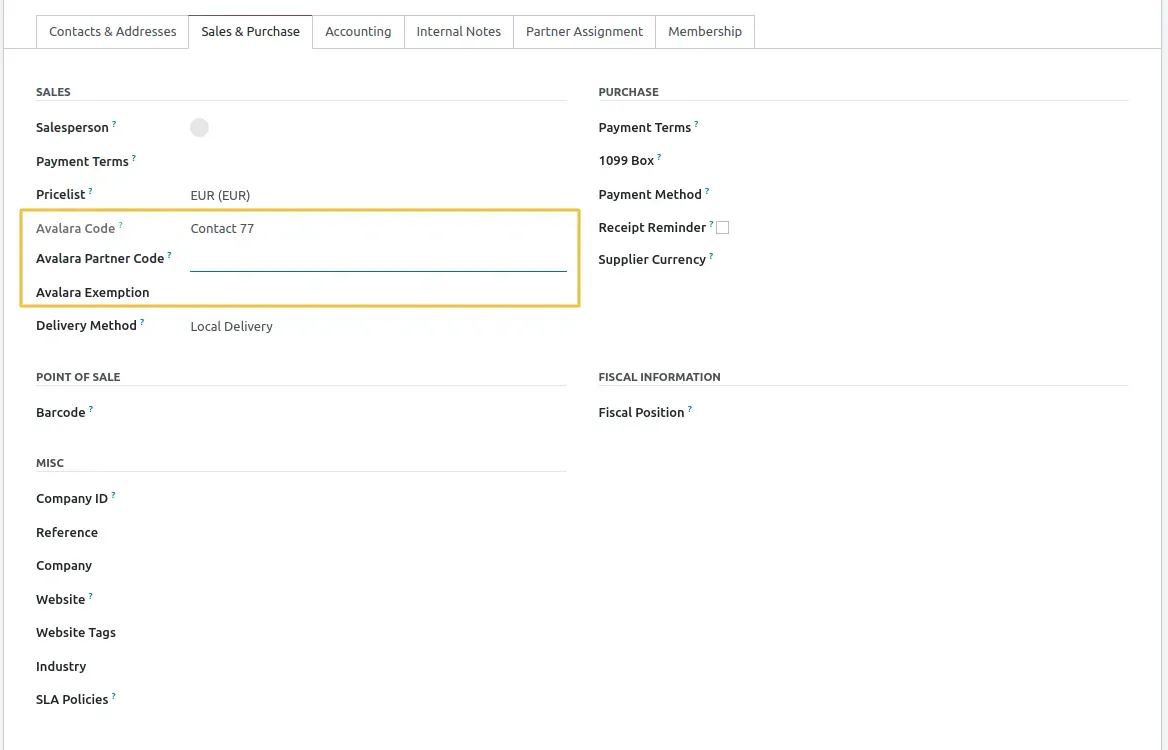

Step 5: Tax Exemptions

To ensure accurate application of taxes based on transaction details, navigate to the Contacts section of Odoo and complete the relevant fields to indicate whether the customer or vendor is sales tax exempt. A variety of options are available to specify the nature of the client's business.

Important note: this feature is not currently available in Taxcloud's default setup and requires customization to implement.

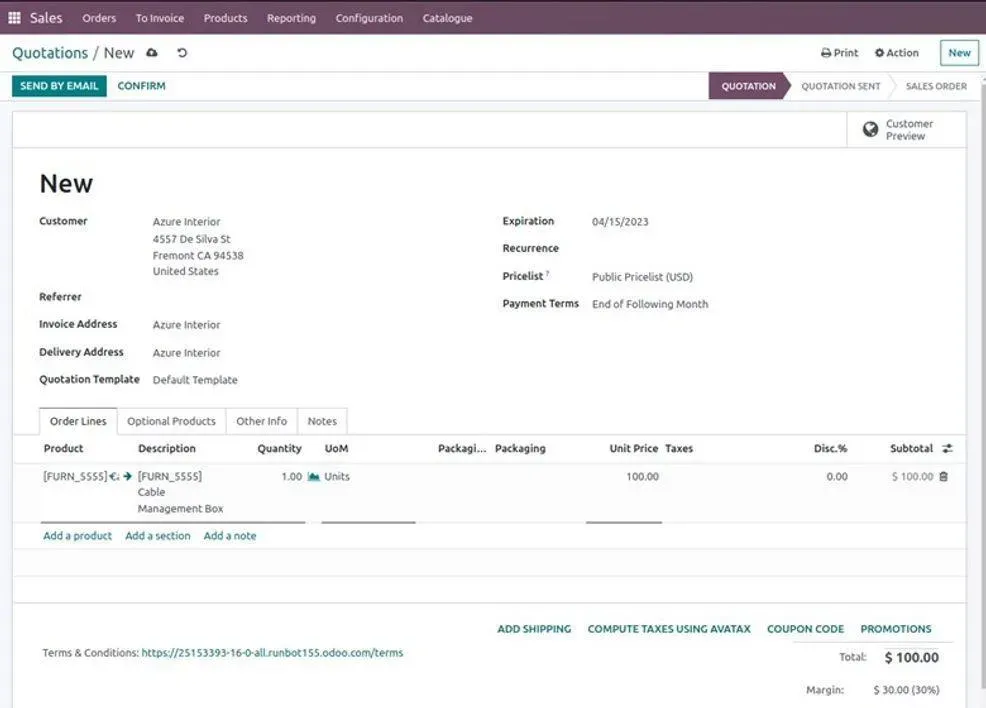

AvaTax and Taxcloud in Action with Odoo

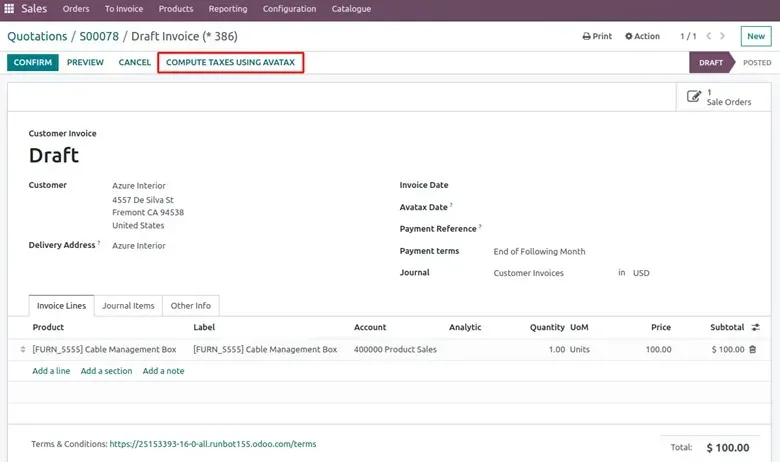

After completing all necessary configurations, AvaTax and TaxCloud will be ready for use during transaction registration in Odoo. When creating a new quotation, users will see an option at the bottom of the screen to calculate taxes. If customer and product details are correctly set up, AvaTax and TaxCloud will calculate the sales tax rate and supply the required information to complete the transaction.

Note:

- There's no need to manually select the tax calculation, as it's automated once you confirm the quotation.

- The same functionality applies to invoices, where the tax computation option is displayed at the top of the screen.

As you can see, integrating AvaTax and TaxCloud into Odoo is a straightforward process. It’s worth implementing because:

- You’ll reduce the time spent on taxing.

- You can focus on more demanding aspects of your business.

View Odoo Case Study: Real Time Accounting

Choosing Between TaxCloud and Avalara in Odoo

Whether TaxCloud or Avalara will be the best choice for you depends on your company's individual requirements. Here are some advantages and disadvantages of each product:

| TaxCloud | Avalara | |

|---|---|---|

Pros |

|

|

Cons |

|

|

TaxCloud and Avalara offer valuable tax automation solutions for American businesses. Choosing between the two, however, depends on:

- Your company's size

- complexity

- Global reach

A SMB may find TaxCloud to be a more cost-effective alternative, while larger enterprises with complex tax needs may prefer Avalara's broad range of services. It's important to carefully consider your unique requirements so you can identify the service that most appropriate for your business.

In Conclusion – The 4 Reasons Why US Companies Use Odoo for Tax

Odoo provides a complete tax management solution, delivering numerous benefits to businesses:

- Savings: It enables significant time and cost savings by automating and simplifying various tax-related processes. Streamlined data entry and error reduction not only reduce operational expenses but also minimize the risk of penalties and audits, promoting financial stability.

- Accuracy: Furthermore, Odoo improves accuracy in tax management by facilitating compliance with constantly evolving tax regulations. This ensures that businesses can stay up-to-date with tax requirements and maintain precise tax calculations and reporting, preventing costly errors or discrepancies.

- Efficiency: In terms of efficiency, Odoo streamlines tax-related tasks and processes, eliminating unnecessary complexities and paperwork. This enables companies to redirect their resources and workforce towards more strategic and revenue-generating activities, resulting in improved overall efficiency.

- Enabling growth: Odoo prepares the foundation for business growth by providing financial stability and readiness for expansion. Its implementation empowers organizations to pursue growth opportunities with confidence, knowing that their tax management is in capable hands.

Overall, Odoo is an invaluable asset for any business seeking to streamline tax-related operations and position itself for future success.

Let's talk about your project