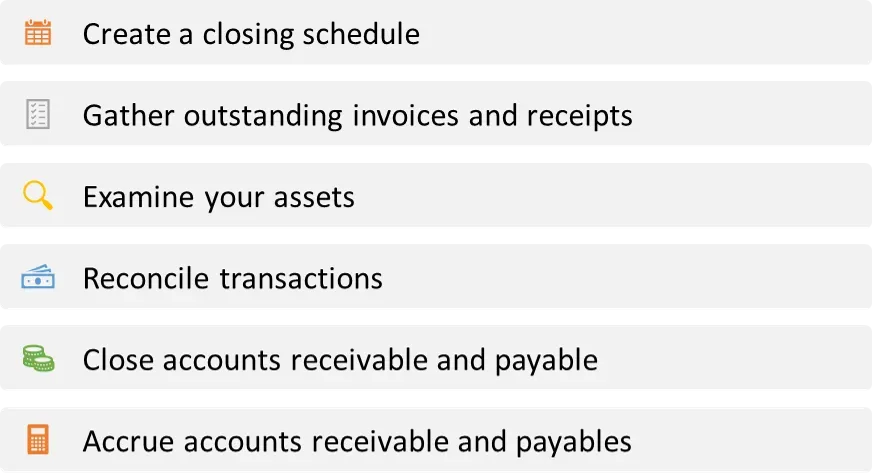

The process through which businesses check and update their accounting records at the conclusion of the fiscal year is known as year-end closure. This is a crucial phase for the company's annual financial reporting process, not only for legal and tax requirements that must be met, but also for financial management. It allows companies to reduce mistakes and avoid future problems.

Another step to consider due to its importance for a correct year transition is:

For this reason, the main topic of this article is Retained Earnings.

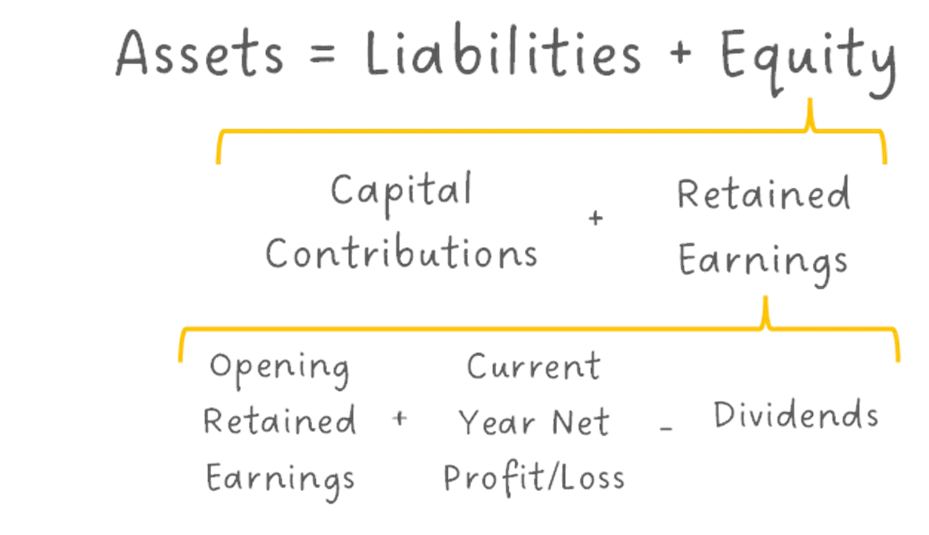

Accounting is based on a balance system, meaning that everything a business owns is equal to what it owes. A company owns Assets and owes Liabilities to third parties and Equity to its owners/investors.

Focusing our attention on Equity, the two rubrics that compose it are: Capital Contributions and Retained Earnings. The Capital Contributions constitute the owner's private investment, whether in cash or goods/assets; and the Retained Earnings may be understood as the accumulated portion of income that a business holds for future uses. This is usually the account that investors seek to examine the business performance.

However, Retained Earnings consists of the following elements:

- Opening Retained Earnings, that is the amount carried over from one period to another;

- Plus the Current Year Net Profit/Loss, which is the difference between income and expenses incurred in the period under analysis;

- Minus the Dividends, which are operating profits distributed by partners or other stakeholders.

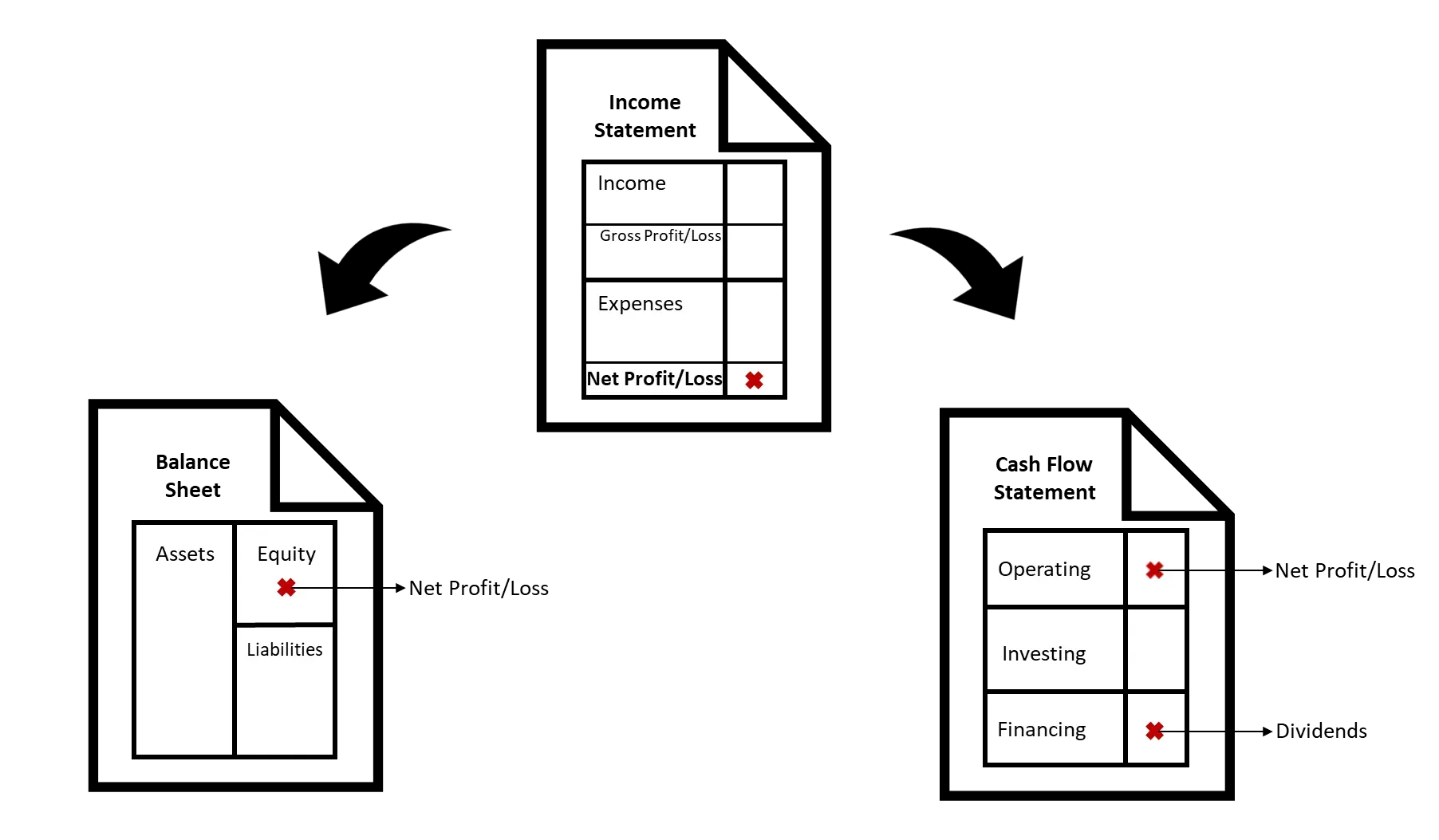

To do this calculation with accuracy, we use the Income Statement, or more commonly, the Profit and Loss Report (P&L for short) to estimate the Net Profit or Loss. This result will be the key that will link all Financial Statements together, reinforcing its importance for accounting, management, and stakeholders, as can be seen in the following scheme:

As mentioned, the Retained Earnings are cumulative from one year to another. That is, the value should be updated each time a new fiscal year begins, according to the logic: Final Balance from Year N = Initial Balance from Year N+1.

Most ERP software requires running all this process manually, but not Odoo!

Odoo once again distinguishes itself, simplifying the process and reducing dispensable task time, calculating Current Year Earnings in real-time. It reports the P&L balance to the Balance Sheet automatically, not requiring a specific year-end closing entry to close the Income Statement accounts.

First, be aware that for closing the year and keeping every data unchanged, it is suggested to Lock the Date for Non-advisors users so that only users with the Advisor role can edit accounts before and including that date.

Commands: Accounting >> Accounting >> Lock Dates

Throughout the below example, let’s see how to perform the Allocation of the Current Year Earnings in Odoo and finalize the closure of the fiscal year.

Initial scenario

As explained above, Retained Earnings are presented in the company’s Equity on the Balance Sheet Statement, and Odoo has created two very important accounts to help accountants and managers understand the results presented in the current and previous years:

- Unallocated Earnings, which is divided into current year earnings and previous periods’ unallocated earnings.

- And the official Retained Earnings account that reflects the accumulated profit.

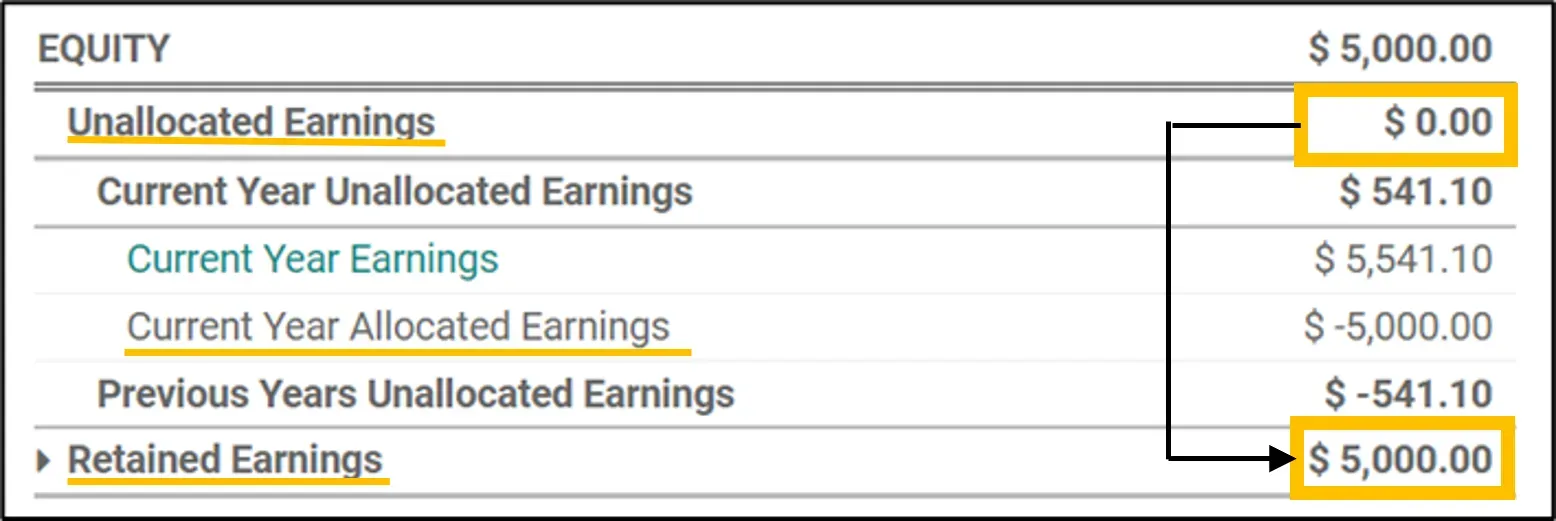

To clarify, the difference between those accounts is that the Unallocated Earnings account works like a suspense account, its purpose being to hold temporary values. So, at the end of the year, one must transfer the $5,000 from Unallocated Earnings to Retained Earnings

Commands: Accounting >> Reporting >> Balance Sheet

How to do the transfer?

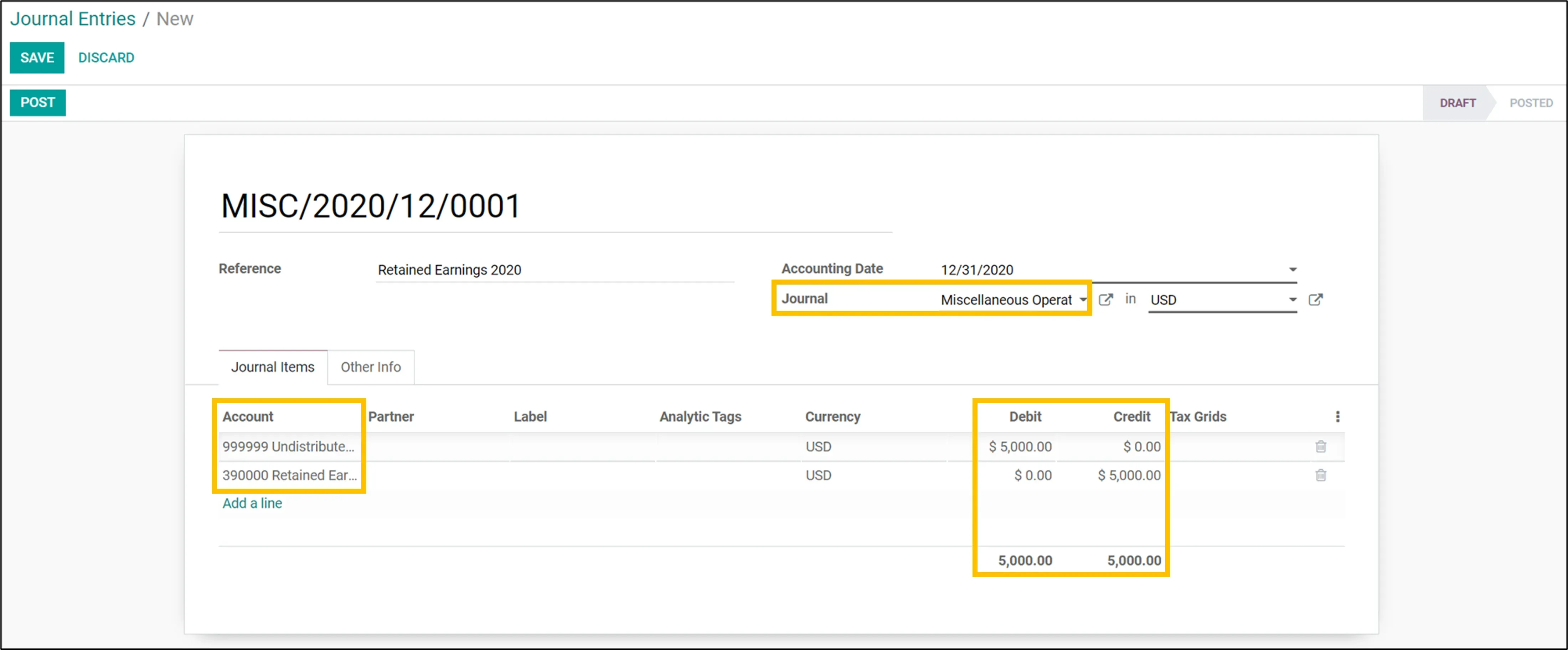

To register this transfer, a journal entry must be created, moving two specific accounts:

- 999999 Undistributed Earnings, this is a default account in Odoo that can be edited, with the condition that its account type remains the same (Current Year Earnings).

- 3????? “Retained Earnings”, is a customized account created to register the counterpart of the previous account, also with a condition on the account type that must be Equity.

Commands: Accounting >> Accounting >> Journal Entry >> Create

Result scenarios

When you save and post the journal entry, the balance sheet displays the balance transfer: $5,000 removed from the Unallocated Revenue account for the next year and moved into the Retained Earnings.

Commands: Accounting >> Reporting >> Balance Sheet

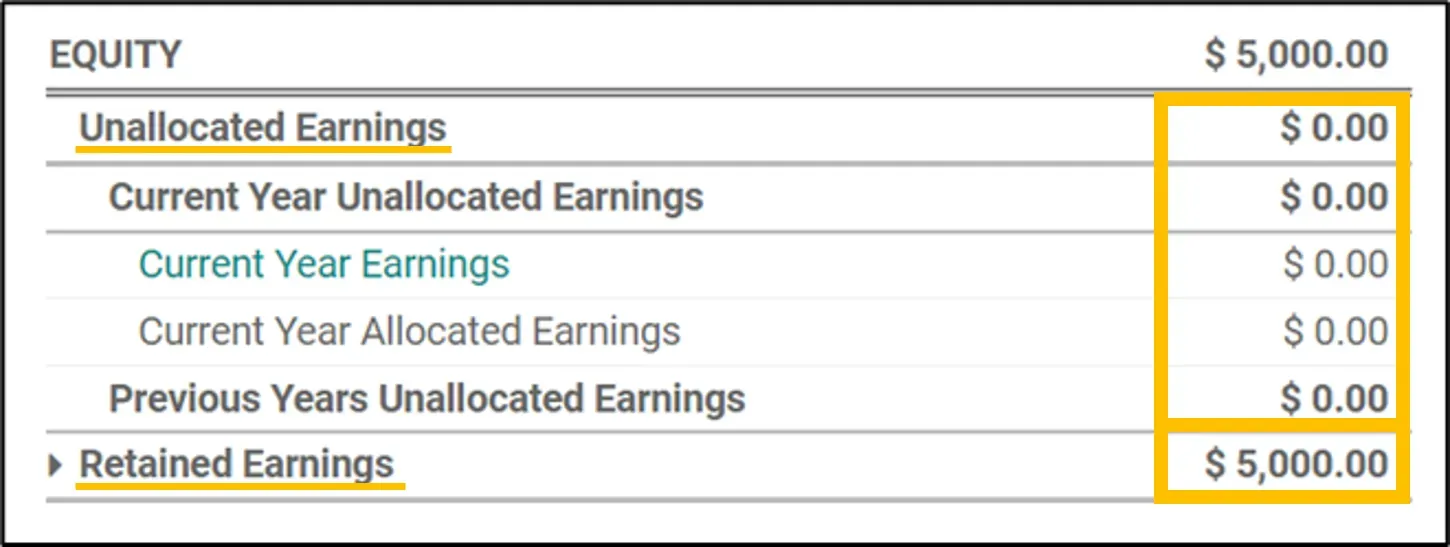

As of End of Last Financial Year The following image shows what the next fiscal year will look like

Commands: Accounting >> Reporting >> Balance Sheet >> As of: Custom >> 01/01/N+1 >> Apply

Finally, once the Current Year Earnings have been allocated and other final adjustments have been made, Lock the Date for all users, to prevent users, including advisors, from editing accounts before this date.

Commands: Accounting >> Accounting >> Lock Dates