Odoo Version 13 brings you a set of new features in all applications but it was the Accounting module that stood out the most. In this article, we will talk about the most useful new features and how they can improve usability and efficiency for accountants.

Bank Reconciliation

Let’s start with the improvements to the reconciliation. This was a tricky task. Accountants had a hard time managing it and finding the most functional way of doing it could be a challenge. You may have experienced many obstacles when reconciling invoices from a specific customer or vendor as well as allocating a single payment to multiple invoices. So, in this new version, Odoo streamlined this task.

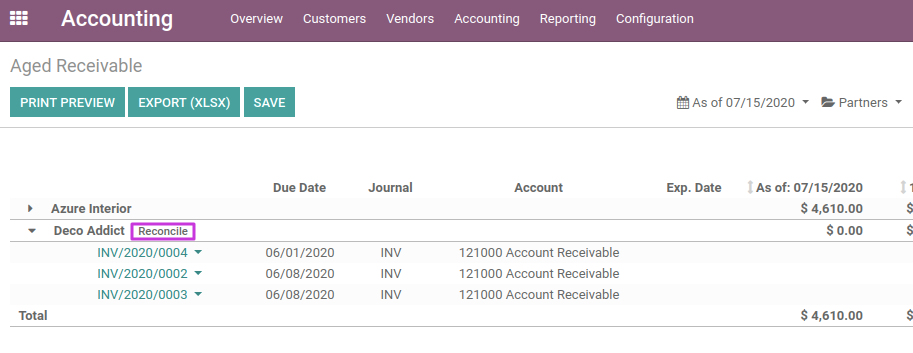

In version 13 you are now able to reconcile open entries from Aged Receivable or Aged Payable reports. This way you can easily reconcile entries from a specific partner with only one click.

It is much easier now to allocate multiple invoices to the same payment and it’s not necessary to change line by line at the bank statement as before. You can simply go to the payment and choose the invoices linked to it.

There are two new fields related to bank statements:

- “Note”

- “Transaction Type”

These fields allow you to have all possible information about the bank statement: some valuable details such as bank terminal barcodes or know whether it’s a fee transaction. These are just two examples and they can help you a lot with reconciliation models. Reconciliation models are unquestionably practical for automating account detection based on rules created with the bank statement fields. There is no doubt that the addition of these new fields has made the whole process more efficient.

Before, Odoo had a QR code for customers’ invoices but now it also has this feature for supplier payments. So, if you want you can pay a vendor bill directly from Odoo by just scanning the QR code.

It is now possible to import statements in a batch instead of one by one, and that can save you a lot of time.

Assets

Assets are also one of the big improvements. Before, it would only be possible to create assets from the vendor bill. It was necessary to choose the category in the line, and an asset would be created according to that. Now, everything is connected to the account and if the Chart of Accounts is well configured, the asset will automatically be created according to the chosen account.

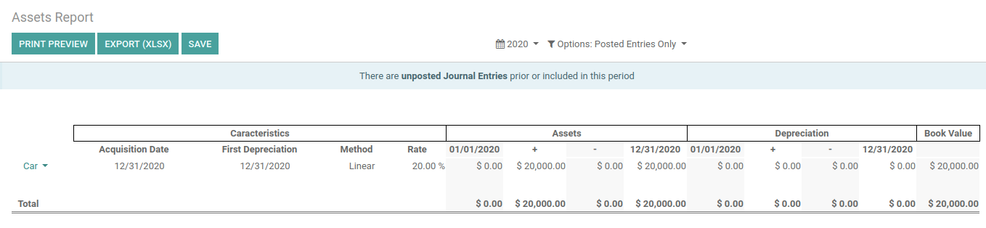

Odoo added a brand new asset report which is an overview of all important information linked to the asset, such as:

- Acquisition amount

- Depreciation that occurred

- Current value

This report is quite useful since you have all information related to assets in one view with no need to lose time trying to find the data. Also, revaluation of the assets is now linked to the asset itself. Whether it’s negative or positive valuations, it will be presented in this report as well.

The last functionality for assets is that Odoo doesn’t take into account only the remaining depreciation to depreciate. Now, you can split between sale or disposal and if you sell the asset, you can link the asset invoice. Apart from the exceptional depreciation, you can also calculate the asset gain or loss:

- You create an account for the exceptional loss or gain that is calculated according to the book value.

- Also reverse the acquisition amount and depreciated value on the balance sheet. This way the assets don’t have a high value anymore.

All this is done in one journal entry generated by Odoo.

Taxes

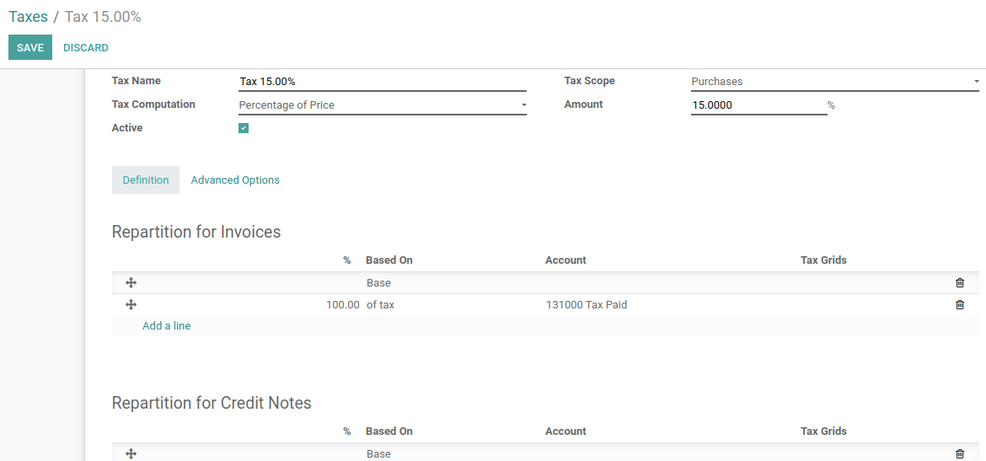

How you configure taxes is the biggest change in this matter. In the past, configuring tax codes that have an impact on multiple accounts was very complex. You needed to create several taxes for each account and link them together. Now, you can configure multiple accounts with the same tax code.

Take note of a warning for situations where you have partners with the same VAT. This is really important because some countries ask for legal reports with all transfers related to a VAT number and if there are different contacts with the same VAT number, you’re taking legal risks.

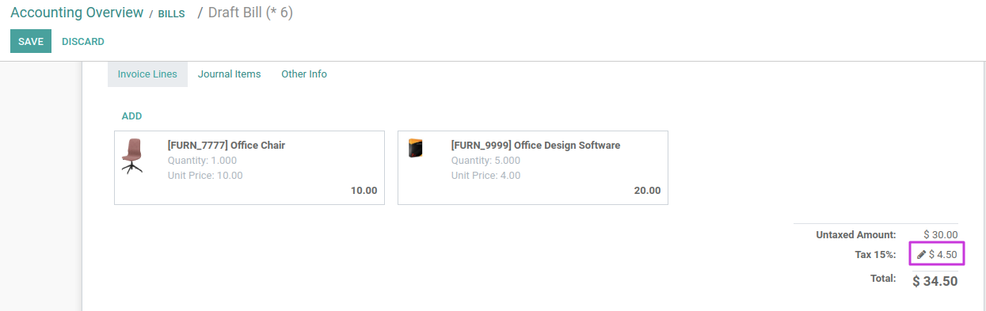

You don’t need to use the calculator or computer anymore to calculate basic formulas such as additions, subtractions, multiplications and divisions. Simply compute the values in the fields, and if something went wrong, it’s now possible to edit the taxes from the vendor bills.

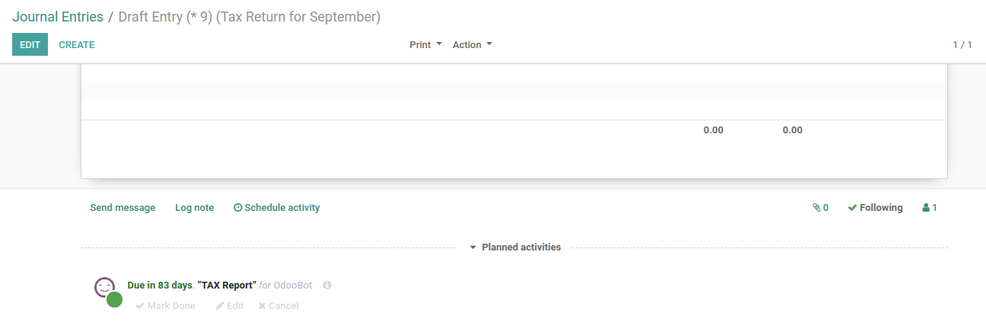

With the Periodical Tax returns there is now a tax lock date. This is how you avoid additional accounting entries for a tax period that is already closed. If you create an invoice for that closed period, Odoo will warn you that period is closed and suggest you book that entry on the first day of the next period. It is also possible now to do a tax reconciliation. You can see all the tax amounts for the period you want to close and easily calculate the amount payable or receivable from tax authorities. This value will be inserted in the balance sheet and it will be easily reconciled when you receive or pay that amount.

General Accounting Improvements

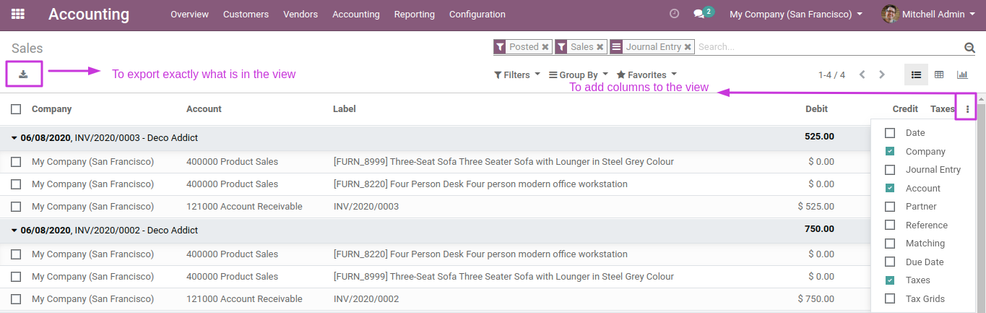

How you export Excel documents from Odoo is now simple, not only in the Accounting module but in all modules. You don’t need to choose the fields you want to export by their technical names in the export widget. It’s possible to export your current view, so you can filter and group by all the data. It’s possible to add or remove columns from the view, and also sort the columns to your preference. If the Documents module is installed, all the documents you export will be saved in this dashboard, making them easier to find and saving you time.

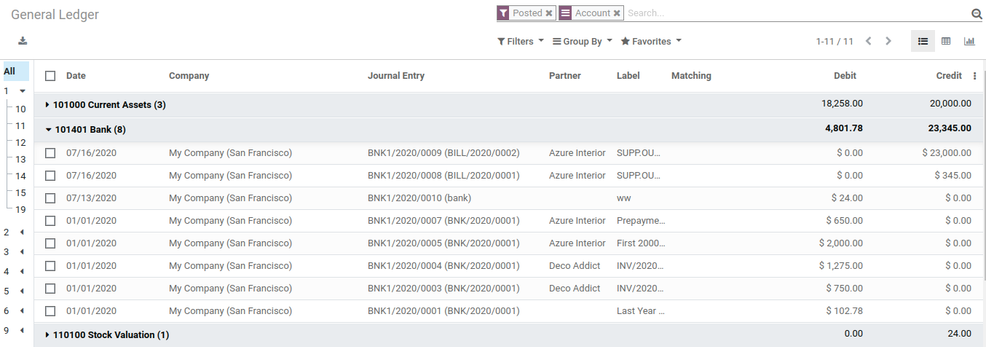

In some views of Chart of Accounts or General Ledger there is a hierarchy available on the left side. It is grouped by accounts and sorted in ascending order. This makes everything more accessible and easier to filter and you can easily find all the journal entries related to the specific account.

Another new feature that also works outside of Accounting is the possibility to change some fields in bulk when you have a list view. This is something incredible that can save you a lot of time. Imagine that you misconfigured an account and now you need to change multiple entries to replace the account. You only need to check the entries you want to change and replace the field with the correct one. When you do it for one line, all the lines selected will change as well.

Besides the chatter on Customer Invoices and Vendor Bills, there is now a chatter for all journal entries as Miscellaneous ones. This will improve the communication level between colleagues and centralize important information related to the entries. Another helpful feature is that if you change a journal entry, that change will be reflected on the invoice/bill in question.

Before, there was the OCR functionality for vendor bills. Now, you also have this for customer invoices. For companies that create invoices outside of Odoo, this will allow you to import more than one invoice at a time and automatically create the invoice without inserting the values. Also, the customers will be created if they are not in the system yet.

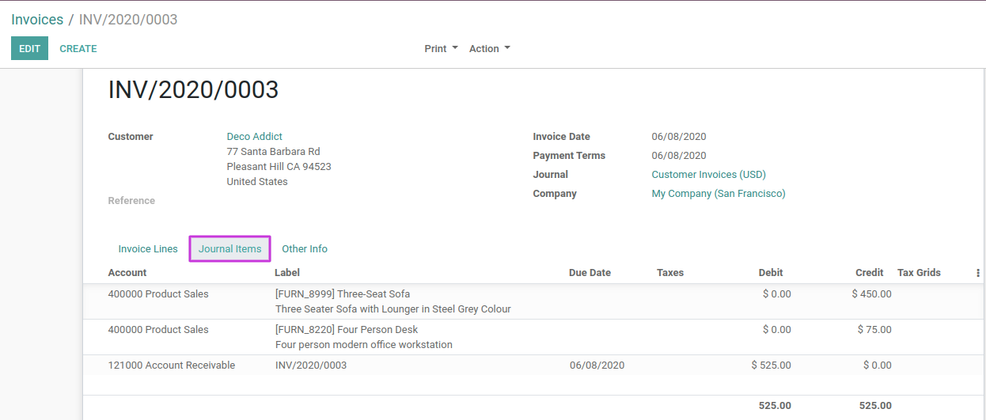

A new tab on invoices and bills named “Journal Items” was created. This allows you to know the impact of that operation in the accounting process even before you post them. This is an effective way to have an idea of what accounts will have new entries and if the configuration is well done.

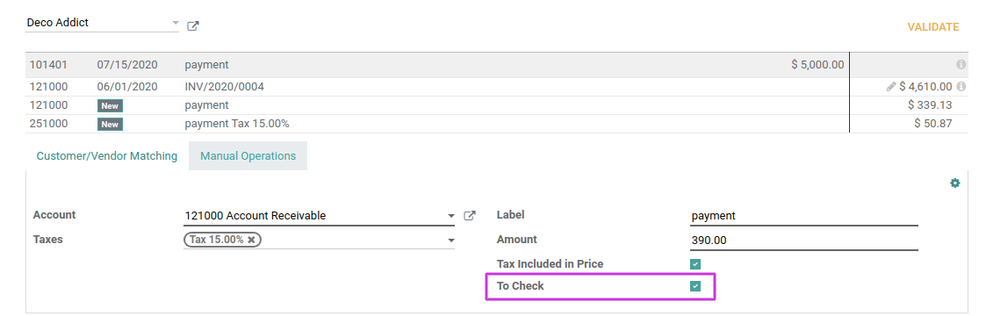

“To check” button is now available in every accounting entry. This button is beneficial to use when you want to reconcile the entries but you need the chief of accounting to check and approve them. All the entries that need to be checked will be visible in the bank dashboard providing a great overview of pending actions.

Also, if there are some doubts about the right account for a specific entry but you want to create bank statements and have the balance up to date, a Suspense Account is a helpful feature to use. It will allocate that entry to the suspense account and it will also appear in the dashboard to reconcile. Now there’s less risk of losing track of actions that still need to take place.

Imagine for a moment that you want to save a future debit in your accounting but since you’re not sure that you will finalize that operation, you don’t want that to affect the balance or P&L report. Odoo now created off balance sheet accounts that allow you to do this kind of operation without affecting the balance and P&L report.

Deferred expenses/revenues have also changed. These entries are used to spread the costs/revenues that were consumed/delivered in the past but will be invoiced and/or paid in the future. It now works as the assets. It will depend on the chosen account and not on the category. So, again, if the Chart of Account is well configured the deferred cost/revenue will automatically be created according to your journal entry.

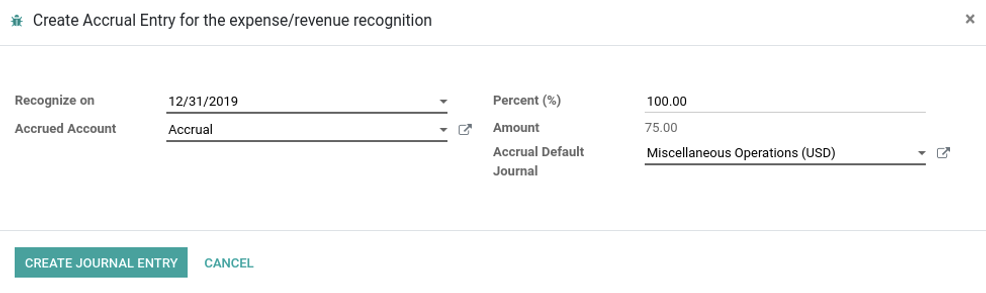

It is so easy to create accrual entries:

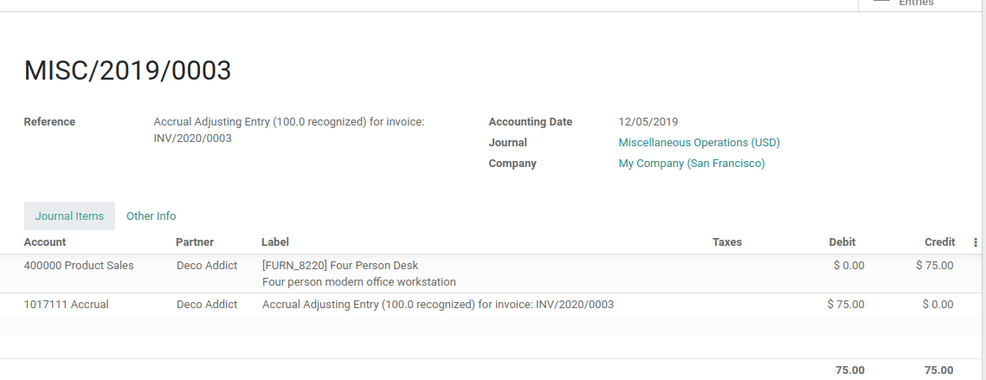

Firstly, Odoo will create a journal entry of the provision for the chosen date. If you enter this item you can see that Odoo kept the invoice number for reference and lastly created the two journal items necessary for the operation as the counterpart and accrual account.

Now the invoice is also updated with the correct account and the revenue moved to the correct date.

Conclusion

To conclude, these are just the most important improvements made in the accounting app. There are up to 108 features that will improve the way accountants work with Odoo, making their workflows much more intuitive and reliable. Performance levels will grow exponentially, since Odoo saves a lot of time in every single operation. This version is now adapted to Accounting firms, so there is no doubt that it will improve the accounting process in any type of company.

Some companies need to integrate some applications in the system that are outside of Odoo and they may even need to customize some aspects to automate their work. This will make it much more efficient. So, don’t hesitate and contact us to enjoy the benefits of a custom setup. We are here to help you grow your business.

Start Now